Great Tips About How To Check Tax Paid

Check how much income tax you paid last year (6 april 2021 to 5 april 2022) estimate how much income tax you should have paid in a previous year.

How to check tax paid. Withholding is the amount of income tax your employer pays on your behalf from your paycheck. Smartasset's hourly and salary paycheck calculator shows your income after federal, state and local taxes. Ron desantis cannot claim he’s fiscally responsible when he spends 12 million taxpayer dollars to fly migrants from florida to martha’s vineyard for a political stunt.

First, you’ll need to log into your account on the city of toronto’s website. This is the fastest and easiest way to track your refund. How do i find out how much i paid in total tax?

Type in the verification code shown in the image. Next, you’ll need to select. A p60 from your employer for the last tax year.

Verify that you meet the income threshold by checking your 2020 and 2021 tax returns, as experts say that the administration will likely estimate your annual income from. If you cannot use these services, you can. It can take up to 5 working days for the records to update.

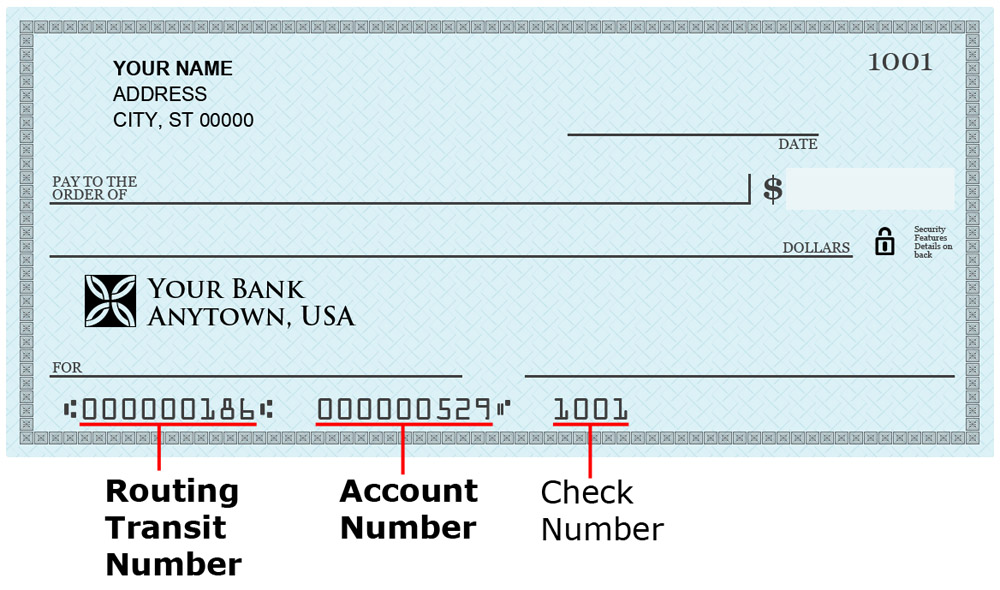

Roll number location on a property tax bill. You’ll also need your national insurance number and one of the following: Enter your info to see your take home pay.

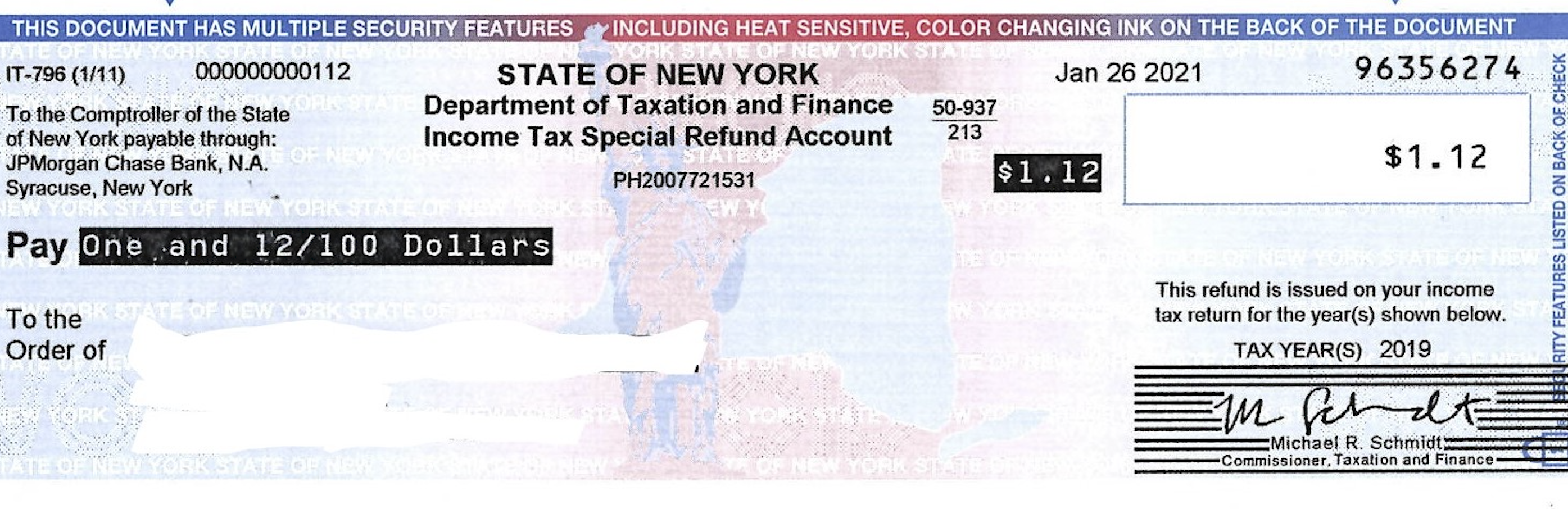

The most convenient way to check on a tax refund is by using the where's my refund? Review the amount you owe, balance for each tax year and payment history. Login to your traces by using the.

Access your individual account information including balance, payments, tax records and. Roll number location on a property tax statement of account. Check your tax code and personal allowance.

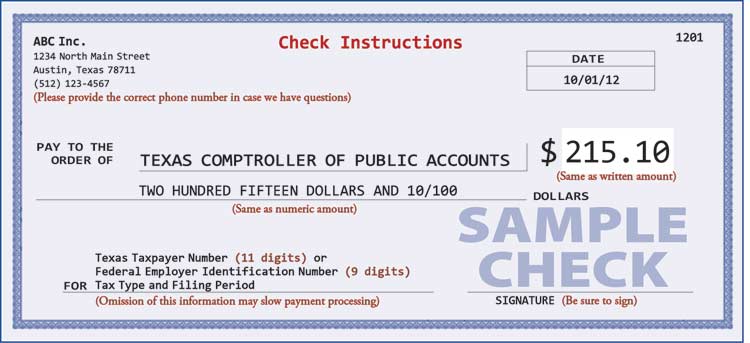

View the amount they owe. Details of your tax credit claim. If you are going to use efps or ebirforms, find out how you can confirm that your taxes were successfully paid online by reading below:

Once you’re logged in, you’ll be able to access your property tax account. The rule about paying at least 110% of last years. If you paid online, you may wish to print, save or screenshot any screens, emails or irs payment receipts confirming your payment.

Youre a farmer or fisher, and youve paid either the full amount of the tax you paid last year or 66.67% of what you owe this year. This service covers the current tax year (6 april 2022 to 5 april 2023). The systems are updated once.

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)